Configuring Payroll Export Follow

With SpringAhead, you have the option to bring timecard information directly into your accounting software and also create a file that can be uploaded or sent to a third party payroll provider. Using this article, you will:

- Become familiar with the different settings

- Configure your payroll export

Reviewing the Options

- Log in as an administrator.

- Click on Settings, then click My Company.

- Scroll down to the Payables section.

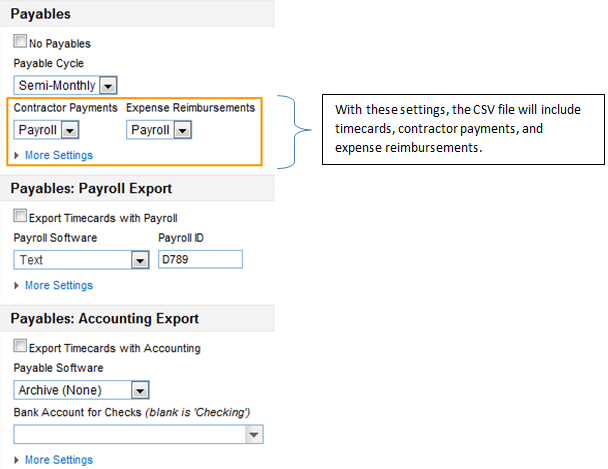

Here is an overview of what the above settings mean:

- No Payables

- Check this box if you never want to export from the payables area.

- This includes:

- Time

- Expense Reimbursements

- Reimbursements are exported as either bills or checks.

- Vendor Payments for 1099 and Corp2Corp contractors

- Vendor payments are exported as checks.

- This includes:

- Check this box if you never want to export from the payables area.

- Payables Cycle

- This setting usually corresponds with your payroll cycle and can be overridden at the user level.

- Contractor Payments

- Direct means payments will be exported to your accounting system as bills.

- Payroll means payment will be exported to your payroll provider as part of a CSV file

- Expense Payments

- Direct means payments will be exported to your accounting system as either checks or bills.

- Payroll means payments will be exported to your payroll provider as part of a CSV file.

- Payables: Payroll Export

- Checking this box brings hourly and salary timecards into your accounting system.

- Note: If you are exporting to a third party payroll provider, do not check this box.

- Checking this box brings hourly and salary timecards into your accounting system.

- Payroll Software

- Generally, this determines where you send your timecards. If you are using QuickBooks or QuickBooks Online Edition, you will want to select Archive (None). Selecting "QuickBooks" will create a journal entry.

- Payroll ID

- If using a third party payroll provider, enter your company ID number here.

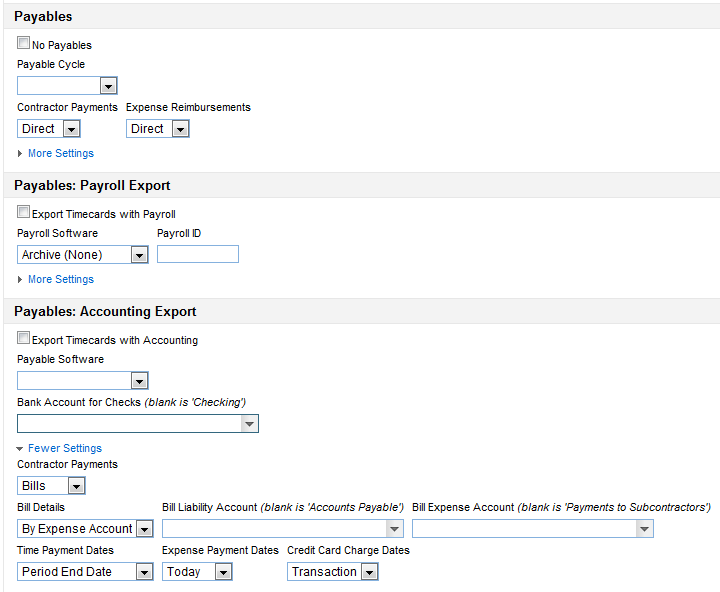

- Payables: Accounting Export

- Checking this box brings 1099 Contractor time cards into your accounting system.

- Payroll Software

- Generally, this is where you will be sending your timecards.

- Bank Account For Checks

- If reimbursing expenses through your accounting system, this is the bank account that reimbursable checks would hit.

If you will be paying your vendors through your accounting system, click More Settings.

- Contractor Payments

- Sets up these transactions to export to your account system as bills

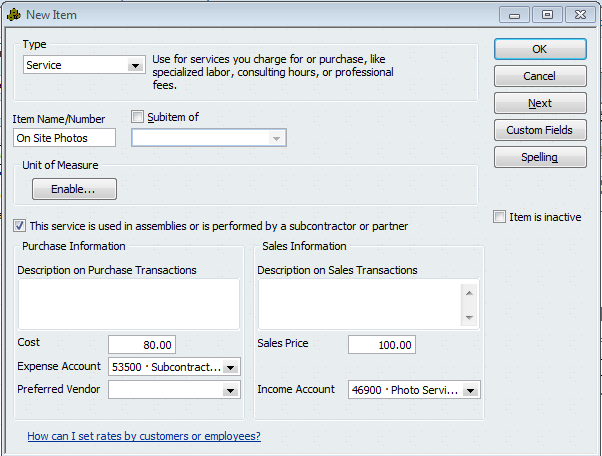

- Bill Details

- By Expense Account

- Bill Liability Account is generally Accounts Payable.

- Bill Expense Account is where you select which expense account you have set up for contractor time payments (e.g. payments for subcontractors).

- By Item

- Bill Liability Account is generally Accounts Payable.

- Bill Expense Account is left blank.

- By Expense Account

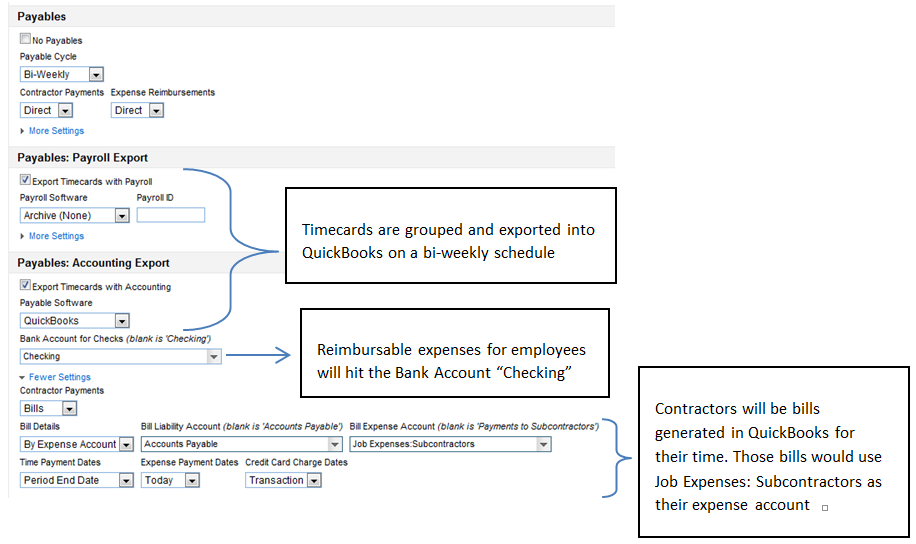

Reviewing Sample Setups

In the example below, these settings are defined:

This setup will export a CSV file for a third party payroll provider.

- This file will be exported to your desktop: